Six Reasons to Extend Superannuation Contributions to 6%

New Zealanders are Living Longer

The retirees of 2022 will be those born in 1955 when the life expectancy for males was 68, and for females 73. Life expectancy is now 80 for males, and 83.5 for females – we are living 13-15% longer, with men having 12 more years of retirement, and women having 10 more years of retirement they need to plan and save for.

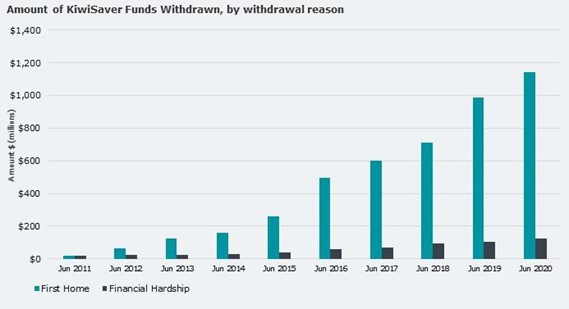

Kiwisaver is Increasingly Important for First Home Buyers

Kiwisaver is a one of the main safeguards for first home buyers being able to compete with the equity of owners of multiple properties. There is a need to keep Kiwisaver contributions increasing alongside house prices, especially as the annual increase in Auckland house prices to November 2021 was 27.9%.

Over a billion dollars was drawn out in the year to June 2020 to support first home buyers. Increasing Kiwisaver contributions increases the ability of employees to purchase their first home.

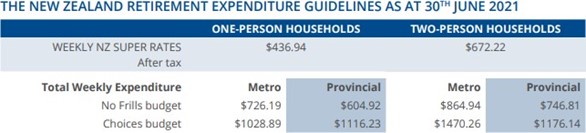

The Cost of Retirement is Growing

Most New Zealanders want a better standard of living in retirement than NZ Superannuation can achieve. For two person households they need to save a lump sum of $809,000 to have a retirement with ‘choices’ in a metropolitan area. A one person household wanting a ‘no frills’ lifestyle in a metro area needs to save at least $293,000 before retirement. The No Frills guidelines reflect a basic standard of living that includes few, if any, luxuries. The Choices guidelines represent a more comfortable standard of living, which includes some luxuries or treats.

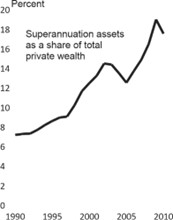

Boosting Superannuation Reduces Wealth Inequality

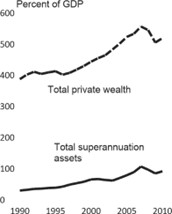

52% of New Zealanders have a superannuation asset but superannuation assets make up only 5% of the value of all assets. By contrast in Australia, since the introduction of compulsory employment based superannuation the share of total wealth held as a superannuation asset went from 7.3% in 1990 to 17.4% in 2010. Superannuation is seen as one of the key reasons for Australia’s relatively even wealth distribution.

Total Private Wealth and Total Superannuation Assets, Australia, 1990-2010

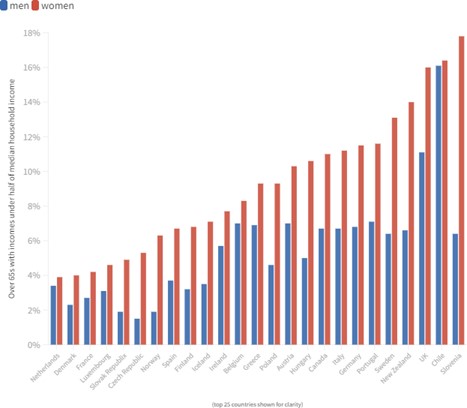

Investing in Superannuation/Kiwisaver helps address Gender Equality

Investing in Kiwisaver/Superannuation for the health workforce has potentially far reaching benefits in addressing pay equity issues and the growing disparity of savings between men and women when they reach retirement age. As Radio NZ has reported, women’s KiwiSaver balances for those aged 55-64 are already almost a quarter lower than men’s and New Zealand’s rate of gendered income inequality for over 65s is high. The DHB workforce is a key area where higher retirement savings will particularly benefit women as of the 81,940 DHB employees in September 2021, 77% of them are women.

Kiwisaver and Superannuation Builds Economic Resilience

Every dollar invested in Kiwisaver has been described as “probably more valuable than any other” because it is NZ’s largest pool of domestic savings, and Australia’s $3 trillion in savings has “shielded it from recession for the past 26 years”. The money is available to invest in infrastructure and because the money is locked up for a long term, fund managers can use it for venture capital and private equity, start up funding. As CEO of Simplicity Sam Stubbs says, “KiwiSaver money is special. It will slowly transform New Zealand from a capital-poor to a capital-rich economy, just as it has in Australia, Europe and America. It will be invested for a long time, and it will be our money. It will fund many start up and SME companies, directly or indirectly, with low interest rates accelerating this. It won’t happen quickly, but it will happen, transforming our economy long term, helping save it in the short term.”